(In recent years, new fundraising methods have transformed the world of finance and investment. One method, the Security Token Offering (STO), has gained considerable traction. In this article, we will examine STOs—their benefits, legal framework, potential risks, and challenges. We will also look at exciting real-world examples and discuss future developments.

What is a Security Token Offering (STO)?

A Security Token Offering is a fundraising method that allows companies to raise capital through the issuance of digital tokens1. These tokens are backed by tangible assets such as equity, profit share, or debt, providing investors with a legally compliant and regulated investment opportunity. Blockchain is the technology underpinning the issuance.

Security Token Offerings have gained significant attention in the financial world because they revolutionize traditional fundraising methods. The use of blockchain technology offers a more efficient and transparent way for companies to raise funds while providing investors with increased liquidity and security.

When a company decides to launch an STO, it typically creates a whitepaper that outlines the details of the offering. This document includes information about the company, its business model, the underlying assets that back the tokens, and the legal and regulatory compliance measures supporting the offer.

The Basics of STOs

A security token represents ownership in an underlying asset and is governed by securities regulations. This ensures that investors are protected by the same legal frameworks that govern traditional securities offerings. STOs offer a more transparent and secure investment option compared to Initial Coin Offerings (ICOs), which lack regulatory oversight.

Unlike ICOs, which primarily offer utility tokens that grant access to a product or service, security tokens provide investors with ownership rights and entitlements. These rights can include dividends, voting rights, profit-sharing, or even the ability to convert the tokens into shares of the company.

STOs also offer greater investor protection by requiring companies to comply with securities laws. This means that companies must disclose relevant information about their business model, financial history, and potential risks to investors. Additionally, STOs often require investors to go through a Know Your Customer (KYC) and Anti-Money Laundering (AML) process, further enhancing the security and legitimacy of the investment.

How STOs Differ from ICOs

While ICOs gained popularity during the cryptocurrency boom, they were unregulated, exposing investors to considerable risk. STOs, on the other hand, operate within existing legal frameworks, providing investors with a level of protection that was previously absent.

STOs must adhere to securities regulations, though these may vary from country to country. Regulations ensure that companies offering STOs are subject to the same investor protection measures as traditional securities offerings, such as providing audited financial statements and complying with reporting requirements.

Another significant difference is the underlying asset backing the tokens. While ICOs often offer utility tokens that have no intrinsic value, STOs are backed by tangible assets. This provides investors with a more secure investment option as the value of the tokens is directly tied to the performance of the underlying assets.

Furthermore, STOs offer greater liquidity compared to ICOs. Since STOs are regulated, they can be traded on compliant security token exchanges, providing investors with a secondary market where they can buy and sell their tokens. This enhances the overall marketability and attractiveness of STOs as an investment opportunity.

Security Token Offerings have emerged as a regulated and transparent alternative to Initial Coin Offerings. By leveraging blockchain technology and complying with securities regulations, STOs provide investors with a secure and legally compliant investment opportunity. With the potential to revolutionize traditional fundraising methods, STOs offer companies a way to raise capital more efficiently while providing investors with increased liquidity and protection. To participate in a DIGTL-backed security token investment, click here.

The Legal Framework for Security Token Offerings

When it comes to participating in Security Token Offerings (STOs), regulatory compliance plays a crucial role with governments and regulatory bodies developing legal frameworks to ensure the security and protection of investors.

Regulatory Compliance of STOs

STOs are subject to securities laws and regulations in the jurisdictions in which they operate. This means that companies issuing security tokens must comply with registration, disclosure, and reporting requirements, providing investors with transparency and accountability.

Regulatory compliance is essential to protect investors from fraudulent activities and market manipulation. By adhering to securities laws, STOs can help maintain market integrity and stability while the companies issuing security tokens must undergo a rigorous vetting process to ensure they meet the necessary legal requirements.

Furthermore, regulatory compliance also fosters investor confidence. When investors know that an STO is operating within a regulated framework, they can trust that their investments are more protected and that they have legal recourse in case of any issues. Compliance with securities laws also helps reduce information asymmetry between companies and investors, promoting fair and efficient markets.

Legal Benefits of STOs

Operating within a regulated framework offers numerous benefits for both investors and companies. Compliance with securities laws ensures investor protection, reduces fraud and market manipulation, and promotes transparency.

Moreover, regulatory compliance opens up investment opportunities to a wider range of investors who may have been hesitant to participate in unregulated offerings. By providing a regulated and transparent environment, STOs attract institutional investors who typically have stricter compliance requirements. This influx of institutional capital can help drive liquidity and market growth for security tokens.

Additionally, regulatory compliance enables companies to build trust and credibility in the market. By adhering to securities laws, companies demonstrate their commitment to operating ethically and responsibly. This can enhance their reputation and make them more attractive to investors, partners, and customers.

The legal framework for STOs is designed to protect investors and ensure market integrity. Regulatory compliance is crucial for companies issuing security tokens, as it provides transparency, accountability, and investor protection. By operating within a regulated environment, STOs offer numerous benefits for both investors and companies, fostering trust, liquidity, and market growth.

The Benefits of Security Token Offerings

Now that we have a deeper understanding of Security Token Offerings (STOs) and their legal framework, let’s explore the benefits they offer investors, companies, and the financial landscape as a whole.

Increased Investor Confidence

STOs provide investors with a higher level of confidence compared to traditional cryptocurrency investments. Backed by tangible assets, security tokens offer intrinsic value, reducing the risk of market volatility and speculative investments. This increased investor confidence creates opportunities for larger investments and leads to long-term stability.

For example, imagine a real estate STO where investors can purchase security tokens that represent ownership in a commercial property. These tokens are backed by the actual property, providing investors with a sense of security and confidence in their investment. This tangible asset ensures that the value of the security tokens is not solely dependent on market speculation, but rather on the underlying property’s performance and value.

Furthermore, STOs often come with additional investor protections such as regulatory compliance and transparency requirements. These measures help build trust between investors and issuers, further enhancing investor confidence in the STO ecosystem. However, there is still considerable risk for any investor in any asset.

Enhanced Liquidity

One of the key advantages of STOs is the potential for enhanced liquidity. Traditional investment vehicles often entail long lock-up periods, restricting an investors’ ability to access their funds. STOs, on the other hand, commonly offer more flexible liquidity options, enabling investors to trade their tokens on secondary markets and thereby providing increased liquidity and value. To trade or invest in a DIGTL-backed security token, click here.

For instance, let’s consider a startup that raises funds through an STO. Once the STO ends, investors can trade their security tokens on secondary markets, allowing for potential liquidity even before the company goes public or gets acquired. This liquidity option provides investors with the ability to exit their investment if needed, offering more flexibility compared to traditional investments that may require waiting for a specific event or milestone to occur.

Additionally, the increased liquidity in the STO market can attract more investors since they have the opportunity to buy and sell tokens more easily. This liquidity can also contribute to price discovery since the market determines the value of the security tokens based on the dynamics of supply and demand.

Democratization of Investment

STOs have the potential to democratize investment opportunities, allowing retail investors to participate in asset classes that were previously limited to high-net-worth individuals and institutional investors. This democratization of investments promotes financial inclusion and economic growth.

Consider an STO that represents fractional ownership in a private venture capital fund. Traditionally, such investment opportunities were only available to wealthy individuals and institutional investors due to high minimum investment requirements. However, STOs allow retail investors to participate in these opportunities at a fraction of the cost.

This democratization of investment not only provides retail investors with access to previously exclusive markets but also allows companies and projects to tap into a larger pool of potential investors. This increased access to capital can fuel innovation and growth, benefiting both the companies and the economy as a whole.

Real-World Examples of Successful Security Token Offerings

Examining real-world case studies can offer valuable insights into the benefits of Security Token Offerings (STOs). Let’s delve into a couple of noteworthy examples.

Case Study 1: Tokenizing Real Estate

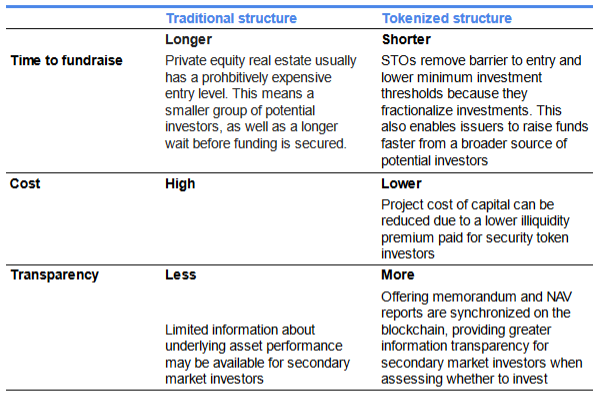

One of the most prominent use cases for STOs is the tokenization of real estate. In this case study, we will explore how Greenfield successfully raised funds through an STO to tokenize commercial real estate (e.g. an office block) in the Kowloon East area of Hong Kong in early 20222. The property carries a gross floor area of 400,000 square feet with an expected development period of 5 years.

Greenfield leveraged blockchain technology to create security tokens that represent partner interests in a private real estate fund, which in turn holds an equity interest in the development project. The token holders have priority in accessing the project’s upsides through the fund’s preferred return, in addition to sharing in other capital gains that may be allocated in accordance with the fund’s distribution waterfall.

Through the STO, the company attracted a diverse range of both institutional and retail investors. The tokens were issued compliantly, ensuring transparency and investor protection. The tokenized nature of the investment also provided liquidity, allowing investors to easily buy and sell their tokens on secondary markets. The tokenized fund will represent 1 billion HKD (10%) of the total funding source.

Case Study 2: Digital Bonds

In January 2023, the European Investment Bank (EIB) unveiled its £50 million digital bond3, built on both private and public blockchains and managed through HSBC Orion – the bank’s new tokenization platform. Innovation notwithstanding, it’s also compliant with the recently embraced Luxembourg legal framework which paved the way for the issuance, transfer, and custody of digitized securities on distributed ledger technology (DLT) infrastructure. Though this STO is not aimed at the retail investor, it remains an example of how big business is moving into the STO space.

For this STO, the company used the encrypted private blockchain to record the legal ownership of the digital bonds. This provided a blueprint for managing the lifecycle of the assets and its floating rate instrument while ensuring unparalleled security. The public blockchain also improves transparency with investors and market participants anonymously accessing information about digital bond holdings. These state-of-the-art digital bonds are often held in digital securities accounts, maintained by HSBC Orion.

Digital bonds promise market participants a world of benefits from slashing costs and amplifying efficiency to real-time data synchronization. A collaborative architecture ensures that all checks and balances between BNP Paribas, HSBC, and RBC Capital Markets operate as they should. HSBC, in particular, is the central account keeper, recording transactions of the digital bonds on the HSBC Orion platform.

Potential Risks and Challenges of STOs

While STOs offer numerous benefits, they also have some risks and challenges that come with this emerging investment method.

Regulatory Hurdles

The regulatory landscape surrounding STOs is evolving, requiring companies to navigate complex legal frameworks and ensure compliance globally. This can pose challenges and delays in launching and scaling an STO.

Regulatory bodies across different jurisdictions have different approaches to STOs, which adds complexity for companies looking to conduct STOs internationally. Navigating these regulatory hurdles requires extensive legal expertise and can be costly and time-consuming.

Moreover, the lack of standards can leave investors uncertain and overly cautious, thereby limiting the growth and adoption of STOs.

Market Adoption and Acceptance

As with any nascent technology, widespread adoption and acceptance can take time. While STOs hold great potential, the broader market may need time to fully embrace this innovative fundraising method.

Investors – particularly institutional – may hesitate to participate in STOs due to concerns about liquidity, market volatility, and the lack of established secondary markets for some security tokens. These factors can hinder the growth and acceptance of STOs as a mainstream investment option.

However, as regulatory frameworks develop and provide clearer guidelines for STOs, market perception is likely to change. Increased regulatory certainty can instill confidence in investors and encourage wider adoption of STOs.

Additionally, education and awareness about STOs need to be enhanced to increase market acceptance. Investors need to understand the benefits and risks associated with STOs. They also need to know how they differ from traditional fundraising methods such as Initial Public Offerings (IPOs) and Initial Coin Offerings (ICOs).

Furthermore, building trust in the security and reliability of STOs is crucial for their widespread adoption. Companies need to demonstrate robust security measures and transparent governance to attract investors and build confidence in the STO ecosystem.

While STOs offer exciting possibilities for fundraising and investment, they are not without risks and challenges. Navigating regulatory hurdles and achieving market adoption will require the efforts of industry participants, regulators, and investors. However, as the regulatory landscape matures and market perception evolves, STOs have the potential to become a significant asset category.

The Future of Security Token Offerings

What can we expect for the future of STOs and their impact on the financial landscape? Let’s explore some of the current trends and project what their potential implications might be if they continue.

Predicted Trends in Security Token Offering Adoption

Studies anticipate a continued rise in STO adoption4 as blockchain technology joins the mainstream5. As regulatory frameworks mature and market participants gain a deeper understanding of STOs, we can expect increased interest from both investors and companies seeking to leverage this innovative fundraising tool.

One of the predicted trends in STO adoption is the expansion of the investor base. As more individuals and institutions interact with STOs, we can expect a wider range of participants to enter the market. This increased diversity of investors can bring new perspectives and ideas, further driving the growth and development of STOs.

Analysts also expect to see specialization STOs across different industries. Currently, we see STOs used primarily in real estate and venture capital sectors. However, we anticipate that issuers will bring STOs to a broader range of assets such as intellectual property, art, and collectibles. This diversification of assets will provide investors with more options and opportunities for portfolio diversification.

How Security Token Offerings Could Shape the Financial Landscape

STOs revolutionize the financial landscape by enabling fractional ownership of assets and increased liquidity. This could lead to greater efficiency, reduced barriers to entry, and increased global investment opportunities. As STOs continue to gain traction, they could reshape the way we think about traditional capital markets.

The fractional ownership possible with STOs gives smaller investors access to markets previously out of reach. At the same time, increased liquidity will continue to improve market efficiency. Traditionally illiquid assets such as real estate or private equity can become more liquid through tokenization. This liquidity can attract more investors and increase market activity, ultimately driving economic growth.

STOs can also reduce barriers to entry for companies seeking capital. By offering a regulated and transparent fundraising method, STOs give smaller businesses access to capital previously only available to larger corporations. This can foster innovation and entrepreneurship with more companies able to secure funding for their projects.

Security Token Offerings offer a regulated and transparent investment alternative, providing investors with increased confidence, enhanced liquidity, and access to previously inaccessible markets. While challenges and risks exist, the future of STOs looks promising as regulatory frameworks mature and market participants embrace this innovative fundraising method. Stay tuned for further developments in this exciting space.

Footnotes:

- Security token offerings; https://link.springer.com/article/10.1007/s11187-021-00539-9

- Deloitte Real Estate STO Whitepaper; https://www2.deloitte.com/content/dam/Deloitte/cn/Documents/real-estate/deloitte-cn-re-sto-whitepapaer-chapter-2-en-221101.pdf

- EIB issues its first ever digital bond in pound sterling; https://www.eib.org/en/press/all/2023-030-eib-issues-its-first-ever-digital-bond-in-british-pounds

- NOVA Information Management School; https://run.unl.pt/handle/10362/151318

- “Tokenization”, The Definitive Guide to Blockchain for Accounting and Business: Understanding the Revolutionary Technology; https://doi.org/10.1108/978-1-78973-865-020201006

- Voluntary Carbon Market: Price, Growth, Size and News - December 7, 2023

- Investing in Carbon Credits: What You Need to Know - December 6, 2023

- Buy Personal Carbon Offsets and Reduce Your Environmental Impact: A Step-by-Step Guide - December 5, 2023